Public Budget Hearing and Special Called Meeting

The Cumberland County Commission met for a public hearing followed by a special called meeting to approve the 2024-2025 budget. All Commissioners were present except Commissioner Holbrook.

Some budgets are easier than others, but they are all hard in their own way. This budget was better than most as revenues have been strong for the last several years, particularly sales tax. I want to thank everyone for all the hard work, from the county-wide elected officials and department heads that prepare their individual budgets, to the Finance Department, Jennifer Turner, Christian Kerley, and staff, to the Budget Committee and Chairman Nancy Hyder.

Work began on this budget on May 2, 2024, with all day budget hearings. As usual, many Tuesday and Thursday evenings were set aside to complete the work. Highlights of the budget include no tax increase with a property tax rate of $1.1350. This rate is projected to bring in approximately $25.8 million with a five percent reserve for delinquency. This is an increase of over $400,000 from last year. Sales tax revenues are projected to be just over $22,000,000 (two percent projected growth over actual receipts) with the vast majority allocated to the Board of Education (BOE). Total estimated revenues for the county general fund are projected to be $41,208,360, (excluding the BOE and other funds) and total estimated expenditures of $40,593,877, for a positive variance of $614,483. This is the first time I recall having a positive variance in the projected budget.

The BOE estimated revenues are expected to be just over $70,000,000 with expenditures estimated to be $77,920,550 with a deficit of approximately $7,284,963 coming from BOE fund balance.

In all, the budget for all departments and funds is $185,177,837 million. The BOE (including federal and food service budgets) accounts for approximately 55 percent of the budget, the General Fund 22 percent, Debt Service eight percent, Highway Fund five percent, and Solid Waste two percent.

A five percent COLA will be given across the board to all county employees. This does not include the BOE as they give separate raises. Questions again arose during Budget Committee meetings concerning the pay of many of the county employees, so funds were allocated to have our salary and benefits study updated. I believe this is money well spent as we have grown well past the point of doing this internally. The Parks & Recreation department is getting funding for part-time help, and the County Clerk is adding a position for the new drive through for the permanent location at 1760 South Main Street. Additionally, a position in the General Sessions office was moved from part-time to full-time, and two positions moved from part-time to full-time in the Circuit Court Clerk’s office.

Capital expenditure funding highlights include electronic poll pads for the Election Commission, asphalt sealing and striping at the Community Complex, a server and workstations for Finance, adding a jury box in courtroom 3, five vehicles for the Sheriff’s Department as well as 37 tasers, and 16 HVAC replacements at the jail. It includes a rescue unit, used engine, and bay addition in Mayland, and funds for land acquisition for the Fire Department. We are funding an additional microwave hop for the P25 digital communications system for our first responders, three EMS remounts of ambulances, five Lucas devices and stair chairs for EMS. Solid Waste will be getting more equipment for super compactors and new equipment for keeping the landfill (post closure) in good condition. In total, there is $2,350,562 in capital spending.

The non-profit budget is approximately $200,940 with donations/contracts to the Chamber of Commerce, Cumberland County Playhouse, and the Cumberland County Rescue Squad, as well as the other standard donations.

Again, this budget absorbs all items without a tax increase.

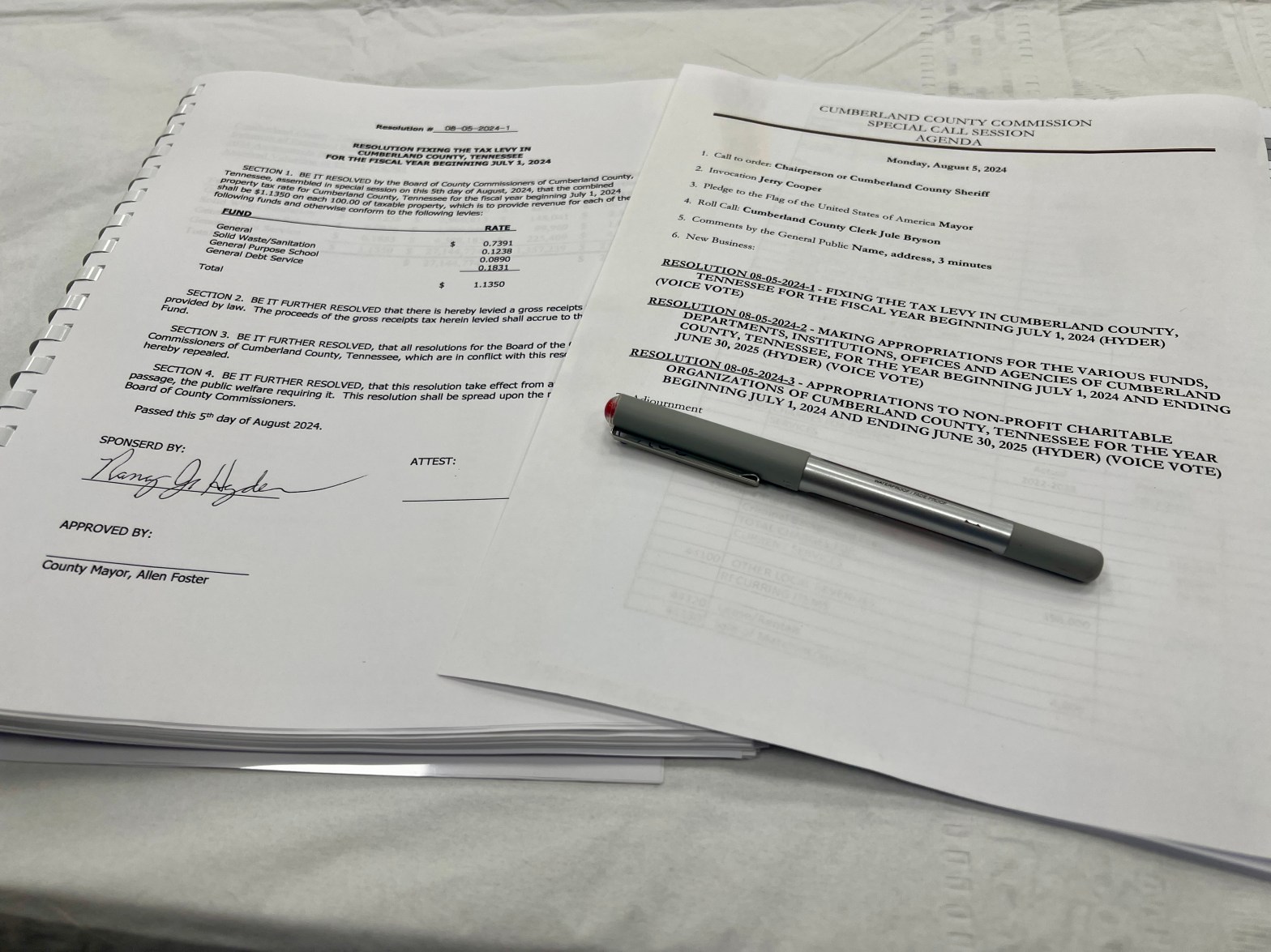

RESOLUTION 08-05-2024-1 – Fixing the Tax Levy in Cumberland County, Tennessee for the Fiscal Year beginning July 1, 2024.

As mentioned earlier, there is no tax increase in this budget. Approximately ½ of a cent was moved from Debt Service to the schools this year. Your tax pennies will be distributed as follows:

General Fund $0.7391

Solid Waste/Sanitation $0.1238

General Purpose School $0.0890

General Debt Service $0.1831

Total Combined Property Tax Rate of $1.1350

This resolution was approved unanimously.

RESOLUTION 08-05-2024-2 – Making appropriations for the various funds, departments, institutions, offices and agencies of Cumberland County, Tennessee, for the year beginning July 1, 2024 and ending June 30, 2025.

This is the resolution that allocates funding and sets budgets for the various items discussed above.

This resolution was approved 15-1 with Commissioner Threet voting against. This was an easy budget for me to support as it is balanced, adds to the General Fund fund balance, takes care of employees, and addresses many capital needs. I was a Commissioner during austere times so it is good to have a budget that addresses so many needs.

RESOLUTION 08-14-2024-3 – Appropriations to non-profit charitable organizations of Cumberland County, Tennessee for the year beginning July 1, 2024 and ending June 30, 2025.

This resolution allocated appropriations to the various non-profits summarized above and was approved 16-0.

Thank you for being part of the solution and for the opportunity to serve as your County Mayor. If you are interested in hearing my thoughts and views on news, events, and activities in Cumberland County, please subscribe to my newsletter, and follow me on Facebook, Instagram and X (formerly Twitter).

Thank you,

Allen Foster

Cumberland County Mayor

http://allenfoster.net